About the Client

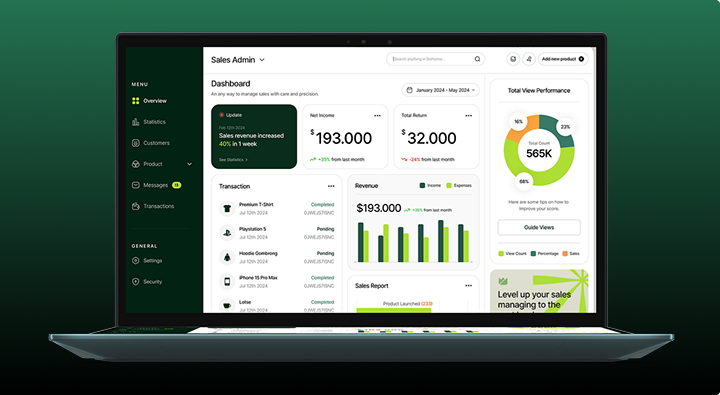

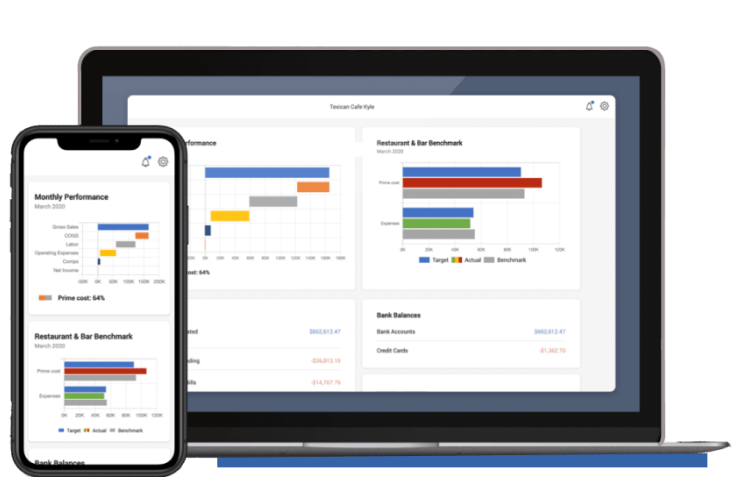

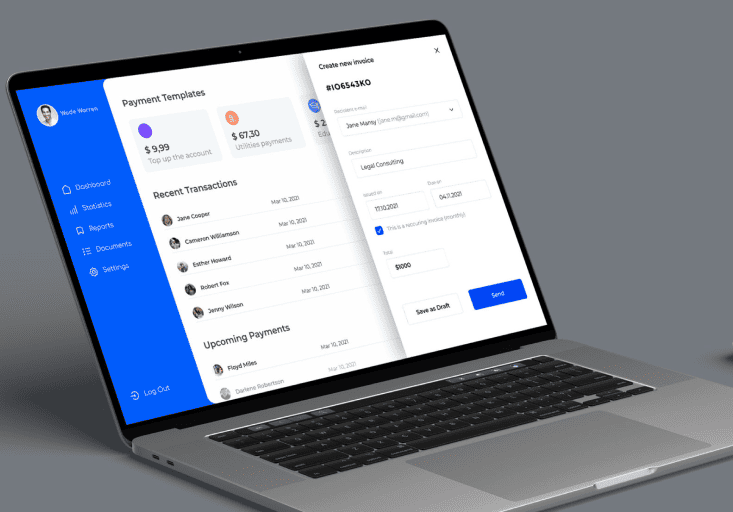

Our client is a pioneer in the world of electronic payments, helping companies access a full suite of robust payment tools. As the product grew, their SaaS platform required substantial enhancements to the core infrastructure and source code performance.